Be in control of how you expand your retirement portfolio by using your specialized knowledge and interests to take a position in assets that healthy with your values. Received skills in real estate property or non-public fairness? Use it to assistance your retirement planning.

As an investor, nevertheless, your options aren't limited to stocks and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can renovate your portfolio.

An SDIRA custodian differs as they have the right employees, skills, and potential to take care of custody of the alternative investments. The first step in opening a self-directed IRA is to find a supplier that is definitely specialised in administering accounts for alternative investments.

Range of Investment Solutions: Make sure the service provider permits the kinds of alternative investments you’re thinking about, for example housing, precious metals, or private equity.

Occasionally, the fees affiliated with SDIRAs is often increased and even more complicated than with a daily IRA. It is because from the improved complexity connected with administering the account.

Complexity and Accountability: With an SDIRA, you might have more Management around your investments, but In addition, you bear additional responsibility.

A self-directed IRA is undoubtedly an exceptionally potent investment motor vehicle, but it really’s not for everybody. Given that the saying goes: with fantastic energy comes excellent duty; and with the SDIRA, that couldn’t be a lot more correct. Keep reading to find out why an SDIRA may, or might not, be for yourself.

Lots of buyers are astonished to learn that making use of retirement money to take a position in alternative assets has become attainable due to the fact 1974. Having said that, most brokerage firms and banking companies center on presenting publicly traded securities, like stocks and bonds, simply because they lack the infrastructure and expertise to deal with privately held assets, such as property or private equity.

Place simply, for those who’re hunting for a tax effective way to make a portfolio that’s far more tailored to the pursuits and skills, an SDIRA could be the answer.

Confined Liquidity: Many of the alternative assets which can be held in an SDIRA, for instance real estate, private equity, or precious metals, may not be browse around this web-site very easily liquidated. This can be a concern if you might want to obtain resources quickly.

Even though there are various Rewards connected to an SDIRA, it’s not without its own negatives. Some of the common main reasons why traders don’t pick SDIRAs incorporate:

The tax advantages are what make SDIRAs beautiful For numerous. An SDIRA is usually equally traditional or Roth - the account variety you end up picking will Web Site depend mostly on your own investment and tax strategy. Examine with all your monetary advisor or tax advisor in case you’re Not sure which is very best to suit your needs.

Assume your Close friend could be starting off the following Fb or Uber? With an SDIRA, you are able to invest in leads to that you suspect in; and likely love bigger returns.

Entrust can support you in buying alternative investments with all your retirement money, and administer the buying and providing of assets that are typically unavailable by way of banks and brokerage firms.

And since some SDIRAs such as self-directed standard IRAs are issue to demanded minimum amount distributions (RMDs), you’ll really need to approach forward making sure that you have sufficient liquidity to meet The principles set by the IRS.

Ease of Use and Technology: A person-helpful platform with on-line tools to trace your investments, submit files, and take care of your account is important.

Larger investment solutions means you can diversify your portfolio beyond shares, bonds, and mutual money and hedge your portfolio towards marketplace fluctuations and volatility.

SDIRAs are sometimes used by fingers-on buyers who are ready to tackle the threats and duties of choosing and vetting their investments. Self directed IRA accounts can also be great for traders who have specialized expertise in a distinct segment market that they want to put money into.

When you finally’ve identified an SDIRA provider and opened your account, you could be wanting check these guys out to know how to truly start investing. Knowledge the two The principles that govern SDIRAs, and also tips on how to fund your account, will help to put the muse to get a future of thriving investing.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Ben Savage Then & Now!

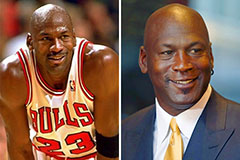

Ben Savage Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!